23+ Sba 504 loan calculator

SBA 504 is a loan product guaranteed by the Small Business Administration for the financing of owner-occupied real estate andor machinery and equipment. SBA 504 Loan Calculator-Please fill in the following information and we will generate a sample SBA 504 loan structure for your project.

2

SBA Share of Project Cost.

. These are one-time only expenses that are financed along with the debenture. See 504 Rate Information on panel at left in order to insert the appropriate current rate into the payment calculator. Find out what this is and why its important to your business.

Bank interest rates and terms are estimated and may be fixed or. To use this business loan calculator enter the loan amount interest rate and repayment term you expect to receive. Calculate your estimated monthly payment.

If this program looks like it would work for you please contact a WBD Loan Officer who can provide you with a more detailed and accurate estimate of your refinancing package options based on your specific needs. The above is an estimated financing structure. These loans are typically used for working capital equipment and refinancing business debt.

Default in national average. Start your business in 10 steps. Using an SBA loan calculator will help estimate the terms and.

Current 504 Loan Rates. Current SBA 504 Interest Rates The above is our best estimate with the information currently available. This calculator is for estimating purposes ONLY.

Calculate your monthly loan payments for a small business loan to help you buy start or expand a business. June 2022 Sba 504 Rates Bfc Business Finance Capital. For certain energy projects the borrower can receive a 504 loan for up to 55 million per project for up to three projects not to exceed 165 million total.

Here are a few SBA 504 loan alternatives. We have created a handy SBA loan calculator for you to utilize to know what your SBA loan payments aka debt service would be. Not sure where to start.

Sba 504 loan rates calculator. This form provides purely ESTIMATED costs. SBA 504 Loan Calculator Project Name Land Land and Existing Building Building Land and New Construction MachineryEquipment Professional Fees ArchitectEngineering Contingency 10 of Construction Costs Interest on Interim Loan Other Expenses TOTAL PROJECT COSTS Lender Interest Rate CDC Interest Rate Are You a Start-Up Business.

SBA 7 a loans. Is the company less than 2 years old. THE BVR INDEX FOR AUGUST 2022 is.

Loans are available for up to 5 million with repayment terms up to 25 years. An SBA 7 a loan is another loan thats backed by the SBA. You can get a brief review of your project utilizing 504 financing by inserting your estimated project costs into the blanks below.

Here are a few key points to consider with SBA loans. This SBA loan calculator adds the guarantee fee to the amount borrowed. SBA Loan Amount Our SBA lenders start at 50000.

A processing fee of 15 is paid to Amplio for marketing screening packaging closing and general. Resources or Loan Forms. Citizens or registered aliens with greencard The business must do business in the United States or its possessions.

SBA Express loans are available. Because you pay this amount up front you dont need to finance. Ownership must be 51 US.

7 a loan interest rates can be either fixed or variable. SBA 504 Loan Calculator. This Calculator will provide a simplified estimate of how the SBA 504 REFI program could work using data you provide.

The fees are calculated on the net debenture amount and are made up of the following components. The rate on the SBA 504 portion is set when the SBA sells the debenture to fund the loan. SBA 504 loans require a down payment.

The actual amount of financing for your project may vary based on the project type number of years in business and appraised value. Ad Get a Business Loan From The Top 7 Online Lenders. Final rates will not be locked in until the financing is secured.

SBA loan monthly payment calculator See how much youll pay Calculate. The maximum loan amount for a 504 loan is 5 million. Why Choose an SBA 504 Loan.

Grow Your Business Now. To be eligible for a 504 loan your business must. Simply enter information below.

504 LOAN CALCULATOR Find out how 504 can work for your project. This calculator can give you an estimate of your loan payments and the total interest cost of most SBA loans. SBA 504 Loan Calculator - BFC - Business Finance Capital The business must be a for-profit non-publicly traded company.

There are a number of fees associated with obtaining an SBA 504 loan. Total Loan Amount. 504 Loan Calculator Enter your project cost and loan rates to determine your estimated monthly payments.

The calculator can also determine your approximate monthly payments. The 504 loan works in conjunction with your local bank resulting in a financing structure typical to a conventional loan but with. CDCs are certified and regulated by the SBA.

Please contact an ISCDC representative at 317 844-9810.

2

2

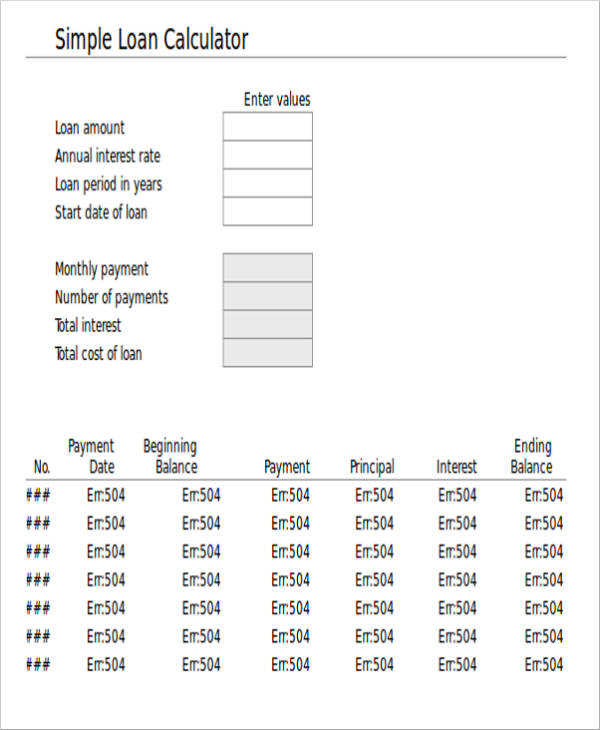

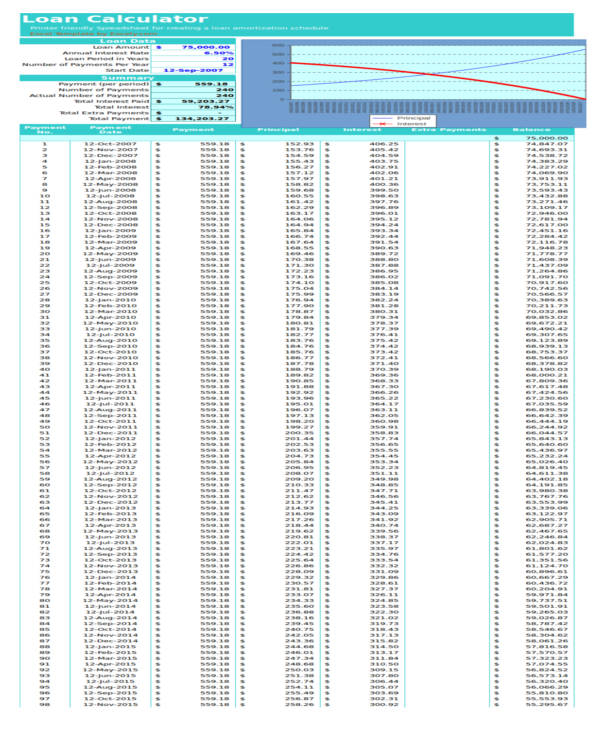

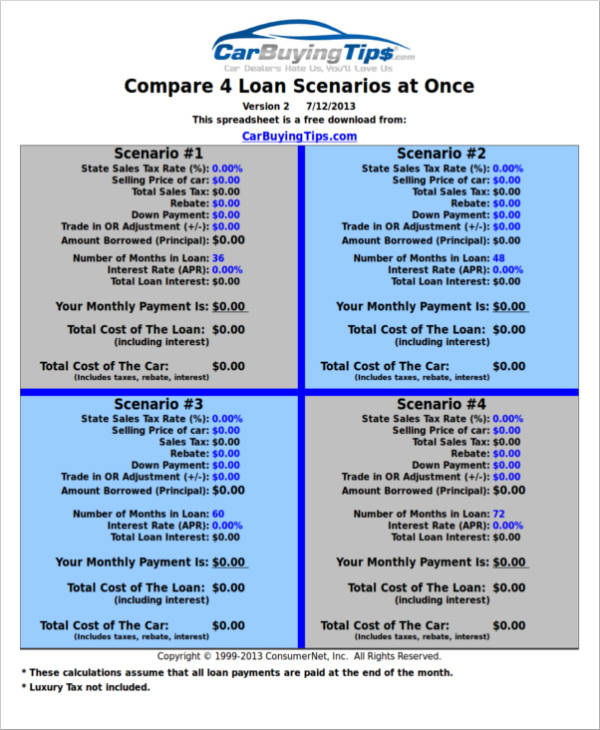

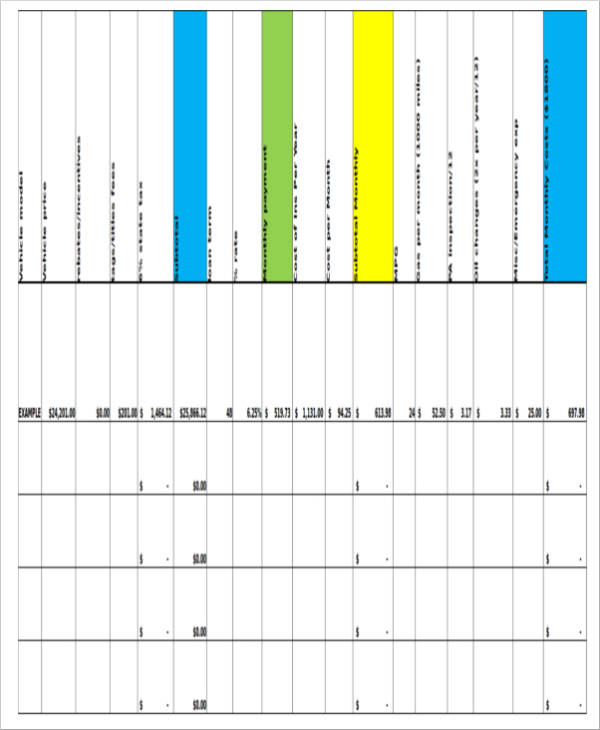

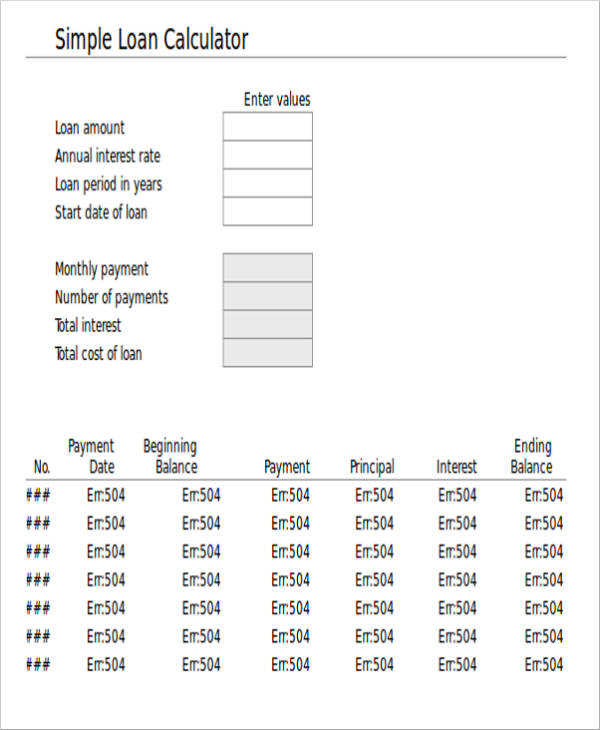

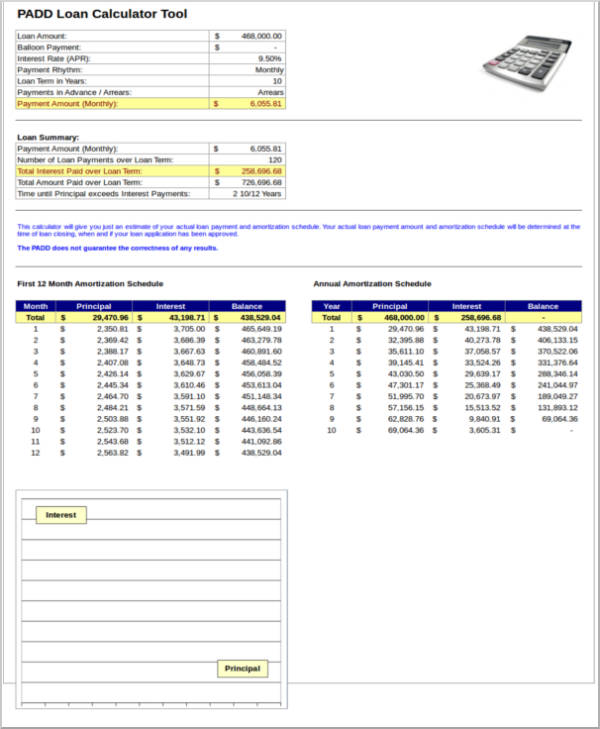

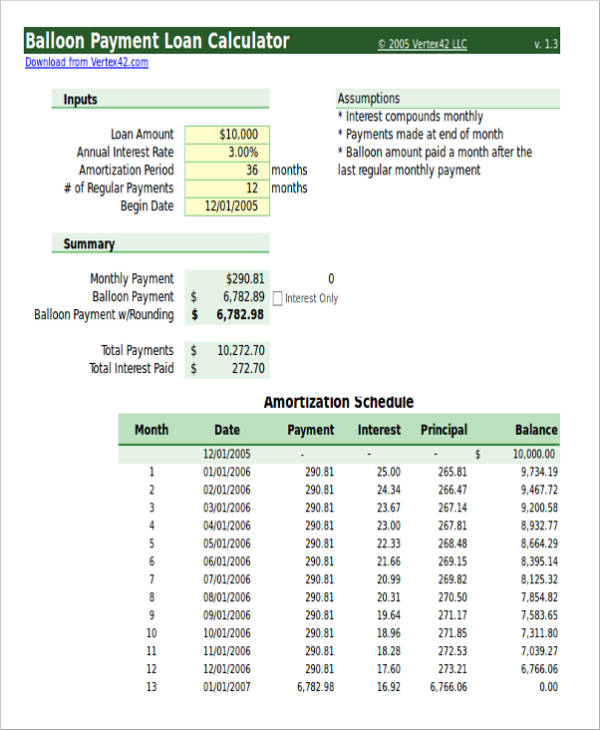

Free 9 Loan Spreadsheet Samples And Templates In Excel

2

2

2

Free 9 Loan Spreadsheet Samples And Templates In Excel

Free 9 Loan Spreadsheet Samples And Templates In Excel

2

Free 9 Loan Spreadsheet Samples And Templates In Excel

Free 9 Loan Spreadsheet Samples And Templates In Excel

Free 9 Loan Spreadsheet Samples And Templates In Excel

2

Hi India March 16 2018 Midwest Edition By Hi India Weekly Issuu

2

Free 9 Loan Spreadsheet Samples And Templates In Excel

2